How to improve Amazon performance

Amazon rewards efficiency, not effort. Yet, many Vendors still react to problems only once performance drops. Let me tell your, that at this point, the real issue has often been visible for months. Hidden in plain sight inside your portfolio data.

What I've seen with our high performing brands is: That they stopped looking at isolated KPIs and started managing their assortment through performance groups driven by conversion, impressions, sales, and Net PPM.

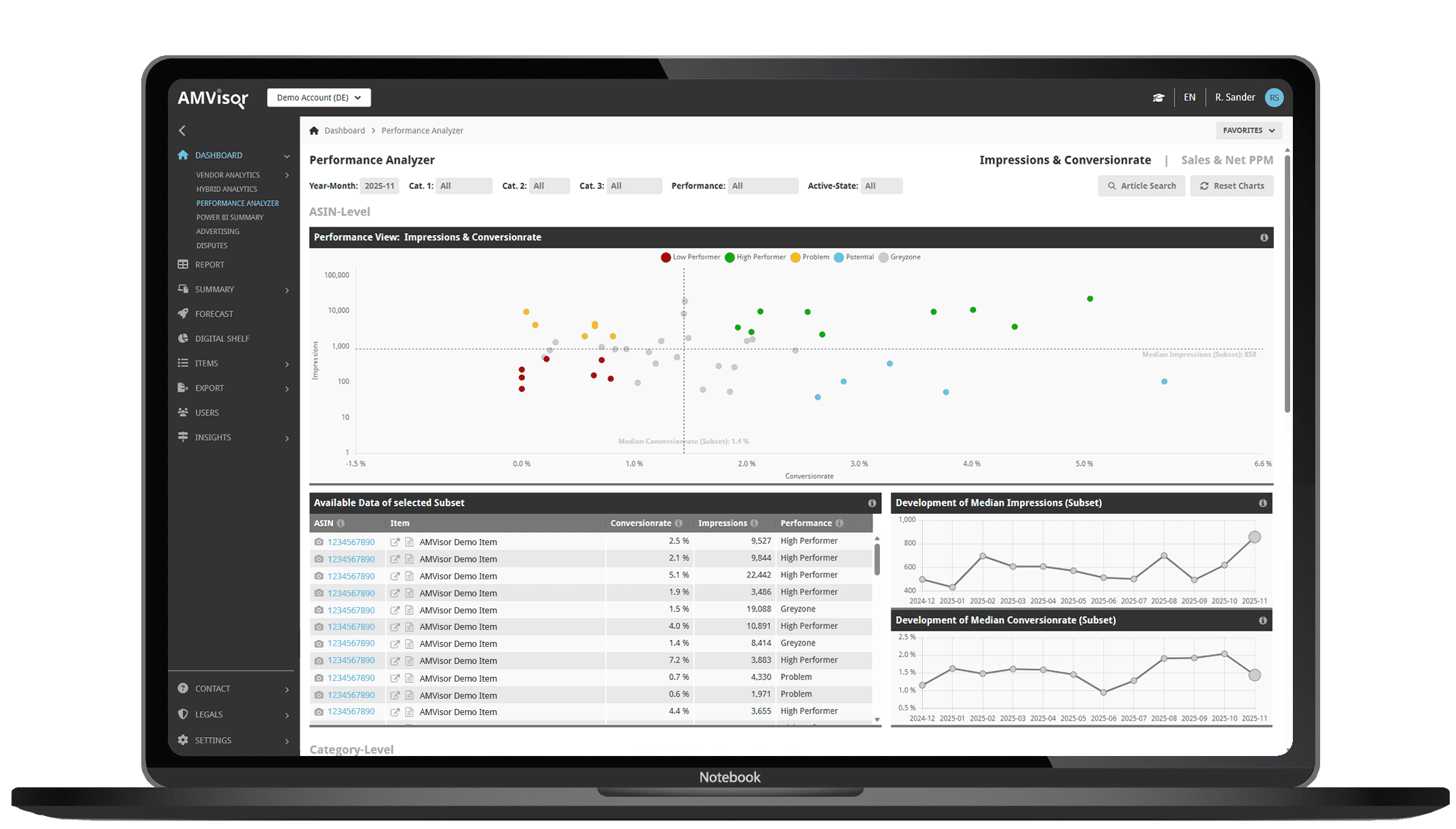

One of the most powerful (and still underused) ways to understand your Amazon portfolio is to group products into strategic performance clusters. This idea was reinforced publicly when Martin Heubel stated at the Amazon Sales Congress 2025 that brands need to see their Amazon listings organized per performance because performance means profit.

This article shows how grouping your Amazon assortment helps you improve both performance and profitability, and why this approach mirrors Amazon’s own benchmarking logic. So, let's dive into it.

Amazon benchmarks your portfolio

Amazon measures your ASINs against competitors and against each other.

Every product in your vendor portfolio creates an internal performance reference. Some ASINs convert better. Some generate visibility more efficiently. Others quietly drain margin while appearing commercially relevant.

High-performing vendors understand this dynamic and manage performance relatively, not absolutely. They focus on deviations inside their own portfolio rather than chasing external benchmarks.

Amazon profitability starts with relative performance

Amazon compares every ASIN against competitors but also against your own assortment.

That means every product sets a benchmark for the rest of your portfolio. Strong conversion? Amazon rewards it. Poor margin? Amazon suppresses visibility. High impressions but low sales? Amazon assumes low relevance.

To improve profitability and performance sustainably, Vendors must manage products relative to each other, not in isolation.

This is where performance grouping becomes essential. Next I’ll show you how the 4 most common performance clusters look like.

Four product performance personas

By mapping ASINs across conversion rate (quality) and impressions (visibility), patterns emerge that indicate how Amazon perceives your products and where to act. These four groups form the backbone of your performance governance:

Get to know your performance personas

Understand how your Amazon assortment is clustered and test AMVisor’s performance analyzer for free with a 2-week free trial.

Four Amazon performance KPIs to focus on

Conversion rate

Is your primary quality signal: Conversion reflects relevance, customer trust, and content quality. When your CVR drops, Amazon instantly reduces visibility, harming both organic and paid performance.

Impressions

Visibility without context ≠ success: Impressions show opportunity, not performance. Only when paired with CVR do they reveal true potential or leakage.

Sales

Demand confirmation, not profitability: High sales with weak margins lead to vendor pressure, reduced profitability, and a weaker negotiation stance.

Net PPM

Amazon’s profitability view: Net PPM shows Amazon’s per 1,000 impressions profit. With that the Net PPM is the KPI that increasingly dictates vendor negotiations. Negative Net PPM can suppress visibility even when sales are strong.

Why performance grouping improves Amazon profitability

✔ You stop wasting ads budget

By shifting budget from “the quite ones” to “underdogs,” you drastically improve TACOS, ROAS, and Net PPM.

✔ You strengthen Amazon negotiations

Grouping reveals margin efficient ASINs and those dragging down profitability.

✔ You gain predictive control

Month over month monitoring shows whether your assortment is improving or only surviving.

✔ You align with Amazon’s logic

Amazon evaluates your catalog exactly this way: relevance, profitability, and efficiency relative to your other ASINs.

How to implement performance governance

Conclusion

All in all performance can only be earned on Amazon, not bought. Amazon vendors I speak to no longer ask, “Is this product performing?”

They ask, “How does this ASIN behave compared to the rest of my assortment?”.

This shift from reactive optimization to performance governance is what separates brands who struggle from those who scale profitably.

Traffic can be bought. Profitability can be measured.

But performance must be managed – systematically, visually, and with the right KPIs.

FAQs

Details that matter!

Details that matter!

Receive our exclusive insights, articles, and announcements in your inbox.